“Fi Money personal loan” in Hindi can be translated as “फाई मनी पर्सनल लोन.” If you want to inquire about their personal loan services or application process, you might use phrases like:

- “फाई मनी पर्सनल लोन की जानकारी कैसे प्राप्त करें?” (How to get information about Fi Money personal loans?)

- “फाई मनी पर्सनल लोन के लिए आवेदन कैसे करें?” (How to apply for Fi Money personal loan?)

- “फाई मनी पर्सनल लोन की शर्तें और नियम क्या हैं?” (What are the terms and conditions of Fi Money personal loans?)

Here are some common features of personal loans:

- Loan Amount: The amount you can borrow may vary based on your eligibility, income, and creditworthiness.

- Interest Rates: Personal loans often come with fixed or variable interest rates. The rate may depend on your credit score and other factors.

- Repayment Terms: Personal loans usually have a fixed repayment period. You’ll need to repay the loan in monthly installments over the agreed-upon term.

- Quick Approval: Some lenders, including online platforms like Fi Money, may offer quick approval processes, providing faster access to funds.

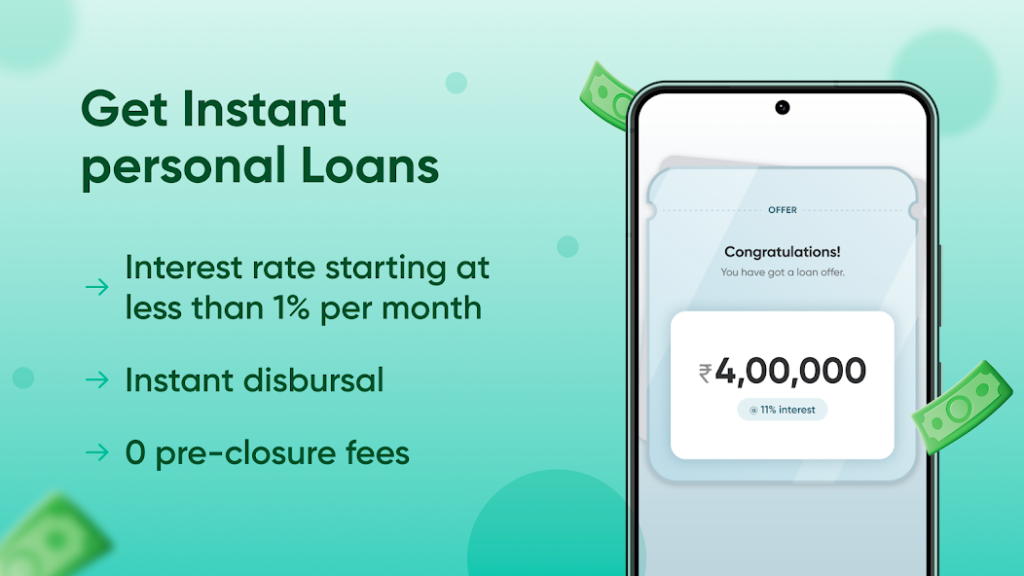

🚀 Interest rates: 15% to 24% per year

💸 Flexible loans: ₹25,000 to ₹5,00,000

0️⃣ Zero pre-closure fees (for Liquiloans)

📲 Approval: 100% digital & paperless

- No Collateral: Personal loans are typically unsecured, meaning you don’t have to provide collateral. Your eligibility is often based on your creditworthiness.

- Online Application: Many lenders, especially digital platforms, allow you to apply for a personal loan online. This makes the application process more convenient.

- Flexibility: Personal loans can be used for various purposes, such as debt consolidation, home improvements, medical expenses, or other personal needs.

- Credit Score Consideration: Your credit score may play a crucial role in determining your eligibility and the interest rate you qualify for.

TARGET CUSTOMERS:

1. Only for Salaried people

2. Age: 23 to 60 years old

3. Experian score >780

4. Monthly Income > 25,000

5. Credit score should be at least from a year

6. PAN And Aadhaar should be there

7. D.O.B. on pan and Aadhar should match

8. User must apply from his own device and mobile number

9. No loan/credit defaults, write-offs should be there

10. No delays in other loan/credit payments over 30 days

apply for a Fi Money personal loan, you can follow these general steps. Keep in mind that the process may vary, and it’s crucial to check the official Fi Money website or contact their customer support for the most accurate and up-to-date information.

- Visit the Fi Money Website: Start by visiting the official website of Fi Money. Look for a section related to personal loans or lending services.

- Create an Account: If you don’t have an account with Fi Money, you may need to create one. This typically involves providing your email address, creating a password, and verifying your identity.

- Provide Personal Information: Fill out the loan application form with your personal details. This may include your name, address, date of birth, employment information, and financial details.

- Submit Required Documents: Fi Money may require documentation to support your loan application. This could include proof of income, bank statements, identification documents, and any other documents they specify.

- Review Terms and Conditions: Carefully review the terms and conditions of the personal loan, including the interest rates, repayment terms, and any fees associated with the loan.

- Agree to Terms and Submit Application: If you agree to the terms, submit your loan application. Some platforms may provide an instant decision, while others may take some time to review your application.

- Wait for Approval: After submitting your application, wait for Fi Money to review and approve it. They may contact you for additional information if needed.

- Receive Funds: Upon approval, the funds will be disbursed to your specified bank account. The time it takes to receive the funds can vary.

How it Works

1. Watch the training video and share the link with eligible customers in your network.

2. The customer needs to enter and verify their mobile number using OTP which should be linked to their Aadhaar and PAN.

3. The customer needs to fill in basic details according to the PAN Card.

4. Then they need to fill personal and professional details after which they will be shown the recommended products as per their eligibility.

5. Select Fi Money and proceed to complete the application process.

6. If customer is not eligible for Fi Money, they can choose any other product from the recommendations.

7. After choosing Fi Money, the customer will be redirected to the play store.

8. Download App from there.

9. Signup with a mobile number on the app. Enter email and name.

10. Allow all permissions and then select instant loans.

11. Enter PAN and D.O.B.

12. Enter work details.

13. Check & confirm the offered loan amount.

14. Complete CKYC using Aadhaar.

15. Provide and verify bank account details.

16. Setup mandatory EMI auto-debit via NACH.

17. Withdraw money in bank account

- 🚀 Side Income Ka Super Formula! – Loan या Credit Card Agent बनकर Mahine Ke Lakhs कैसे कमाएं?

Kya aap bhi soch rahe ho – sirf dusron ki financial help karke apni income max kaise kar sakte ho?Aaj main aapko woh Secret Strategy batane wala hoon, jisse hazaron log financial freedom hasil kar chuke hain. …

Kya aap bhi soch rahe ho – sirf dusron ki financial help karke apni income max kaise kar sakte ho?Aaj main aapko woh Secret Strategy batane wala hoon, jisse hazaron log financial freedom hasil kar chuke hain. … - 💡 Loan Against Mutual Funds (LAMF): The Smart Investor’s Strategy to Unlock Wealth Without Selling

In today’s dynamic financial landscape, investors often find themselves in a cash crunch. Whether it’s an unexpected expense or a lucrative opportunity, the need for instant liquidity is real.But here’s the truth: Selling your mutual fund investments …

In today’s dynamic financial landscape, investors often find themselves in a cash crunch. Whether it’s an unexpected expense or a lucrative opportunity, the need for instant liquidity is real.But here’s the truth: Selling your mutual fund investments … - 💰 Lendingplate Personal Loan – Your Trusted Partner for Instant Funds!

In today’s fast-paced world, financial emergencies can strike without warning – medical bills, wedding expenses, home upgrades, or even education costs. Thankfully, Lendingplate Personal Loans offer a smart, fast, and reliable way to meet your financial goals …

In today’s fast-paced world, financial emergencies can strike without warning – medical bills, wedding expenses, home upgrades, or even education costs. Thankfully, Lendingplate Personal Loans offer a smart, fast, and reliable way to meet your financial goals … - WeRize Personal Loan – Ek Smart Financial Solution Aapke Sapno Ke Liye

Company History – WeRize Ka Safar WeRize ek Indian fintech startup hai jo 2019 mein launch hua tha, jiska main focus hai Bharat ke tier 2 aur tier 3 cities ke logon tak financial products pahuchana. Founders …

Company History – WeRize Ka Safar WeRize ek Indian fintech startup hai jo 2019 mein launch hua tha, jiska main focus hai Bharat ke tier 2 aur tier 3 cities ke logon tak financial products pahuchana. Founders … - Privo : Insta Credit Line Loan

पर्सनल लोन लेना आजकल आम बात है, और इसकी मदद से आप अपनी जरूरतों को पूरा कर सकते हैं। प्राइवो ऐप्स एक ऐसा प्लेटफॉर्म है जो आपको तेज़ी से और सरलता से पर्सनल लोन प्रदान करता है। …

पर्सनल लोन लेना आजकल आम बात है, और इसकी मदद से आप अपनी जरूरतों को पूरा कर सकते हैं। प्राइवो ऐप्स एक ऐसा प्लेटफॉर्म है जो आपको तेज़ी से और सरलता से पर्सनल लोन प्रदान करता है। …