Here’s a detailed blog post on Mutual Fund SIP (Systematic Investment Plan):

Understanding Mutual Fund SIP: A Smart Way to Build Wealth

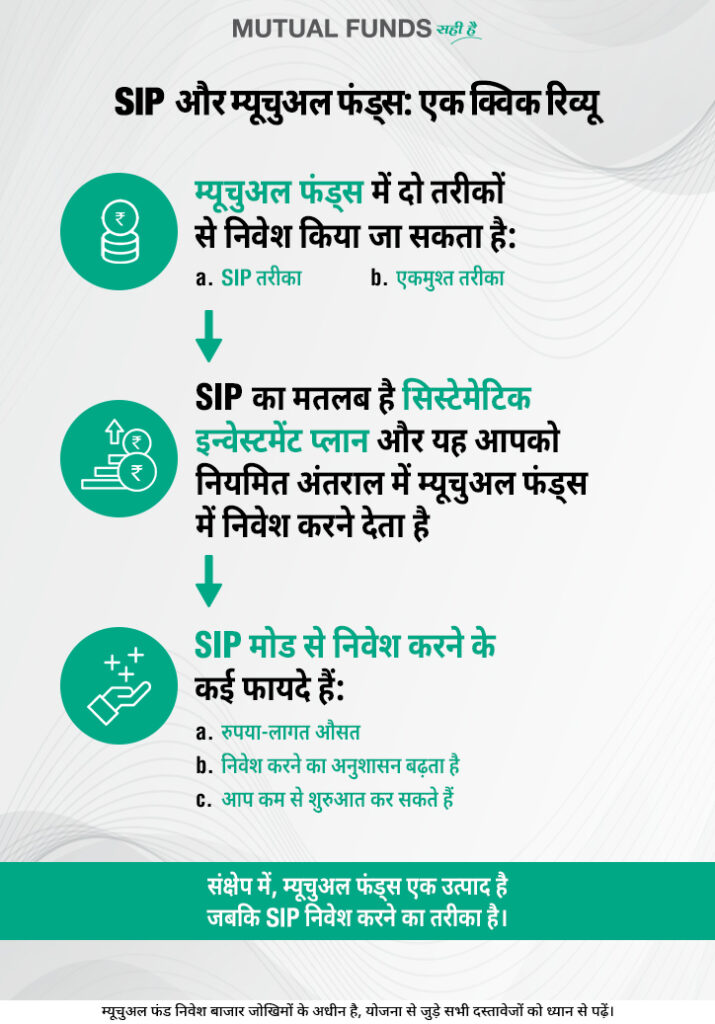

Investing in mutual funds through a Systematic Investment Plan (SIP) is one of the most effective and disciplined ways to build wealth over time. Whether you’re a novice investor or someone with experience, SIPs offer a flexible and convenient way to invest regularly in mutual funds. In this blog, we’ll delve into what SIPs are, how they work, and why they might be the perfect investment strategy for you.

What is a SIP?

A Systematic Investment Plan, or SIP, is a method of investing in mutual funds where you invest a fixed amount of money at regular intervals—usually monthly—into a chosen mutual fund scheme. This regular investment continues over a specified period, allowing you to accumulate units of the fund based on the prevailing Net Asset Value (NAV).

How Does SIP Work?

When you invest through a SIP, the fixed amount you contribute is used to purchase units of the mutual fund at the current NAV. Since the NAV fluctuates with market conditions, you buy more units when the NAV is low and fewer units when it’s high. This is known as Rupee Cost Averaging, which reduces the impact of market volatility over time.

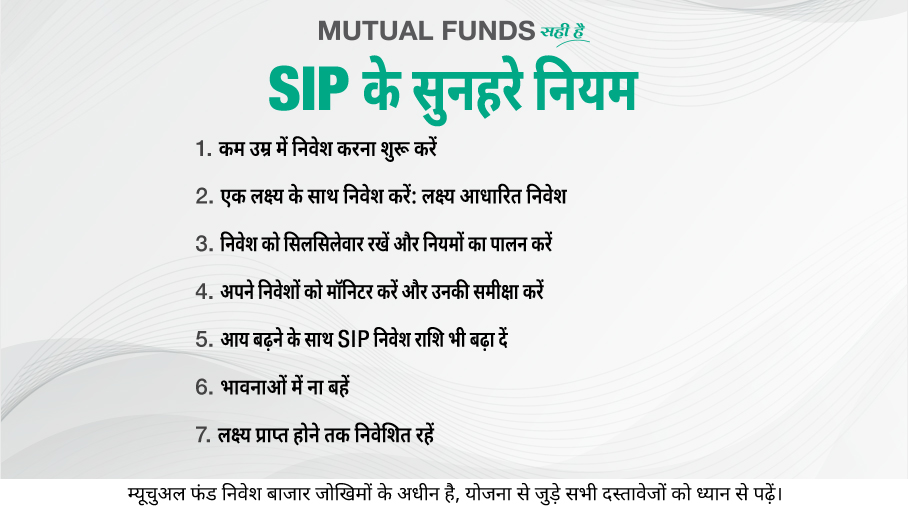

Benefits of Investing Through SIP

- Disciplined Investing

- SIPs encourage a disciplined approach to investing, helping you save and invest regularly without worrying about market timing.

- Rupee Cost Averaging

- By investing a fixed amount regularly, you average out the cost of your investments, which helps mitigate the risk associated with market volatility.

- Power of Compounding

- The returns earned on your investment are reinvested, which leads to the compounding of returns over time. The earlier you start, the greater the impact of compounding.

- Flexibility

- SIPs offer flexibility in terms of investment amount and duration. You can start with as little as ₹500 per month and increase the amount as your income grows.

- Convenience

- SIPs can be easily set up online, and the amount is automatically deducted from your bank account, making it hassle-free.

- Affordable and Accessible

- Unlike lump-sum investments, SIPs make mutual fund investments affordable for all investors, including those with a limited budget.

Types of Mutual Funds for SIP

- Equity Mutual Funds

- These funds invest in stocks and have the potential for high returns over the long term, making them ideal for SIPs. Examples include Large Cap, Mid Cap, Small Cap, and ELSS funds.

- Debt Mutual Funds

- These funds invest in fixed income securities like bonds and are less volatile than equity funds, making them suitable for conservative investors.

- Hybrid Mutual Funds

- These funds invest in a mix of equity and debt, offering a balanced approach to risk and return.

- Index Funds

- These funds replicate the performance of a specific market index and are a good option for passive investors who want to match market returns.

How to Start a SIP?

- Choose a Mutual Fund Scheme

- Research and select a mutual fund that aligns with your financial goals, risk appetite, and investment horizon.

- Decide the SIP Amount

- Determine how much you can comfortably invest each month without straining your finances.

- Set Up the SIP

- You can set up a SIP online through your bank or mutual fund distributor. You’ll need to provide details like the SIP amount, frequency, and duration.

- Monitor Your Investment

- While SIPs are long-term investments, it’s important to periodically review your portfolio to ensure it’s on track to meet your goals.

Tax Benefits of SIP

Investments in Equity Linked Savings Scheme (ELSS) mutual funds through SIP are eligible for tax deductions under Section 80C of the Income Tax Act, up to a limit of ₹1.5 Lakhs per financial year. Additionally, the returns from these funds, if held for more than three years, qualify for long-term capital gains tax, which is lower than short-term capital gains tax.

SIP vs. Lump Sum Investment

SIP is often compared to lump sum investing, where you invest a large amount at once. While lump sum investments can potentially yield higher returns in a rising market, SIPs are generally preferred for those who want to reduce risk and invest consistently over time. SIPs eliminate the need to time the market and allow investors to benefit from cost averaging and the power of compounding.

Common Myths About SIPs

- SIP is a Mutual Fund

- SIP is not a mutual fund but a method of investing in mutual funds. It’s simply a way to invest regularly.

- SIPs Only Work in Bull Markets

- SIPs are designed to work in all market conditions due to rupee cost averaging. They are particularly effective during market downturns, as you accumulate more units at lower prices.

- You Need a Large Amount to Start a SIP

- You can start a SIP with as little as ₹500 per month, making it accessible to everyone.

Conclusion

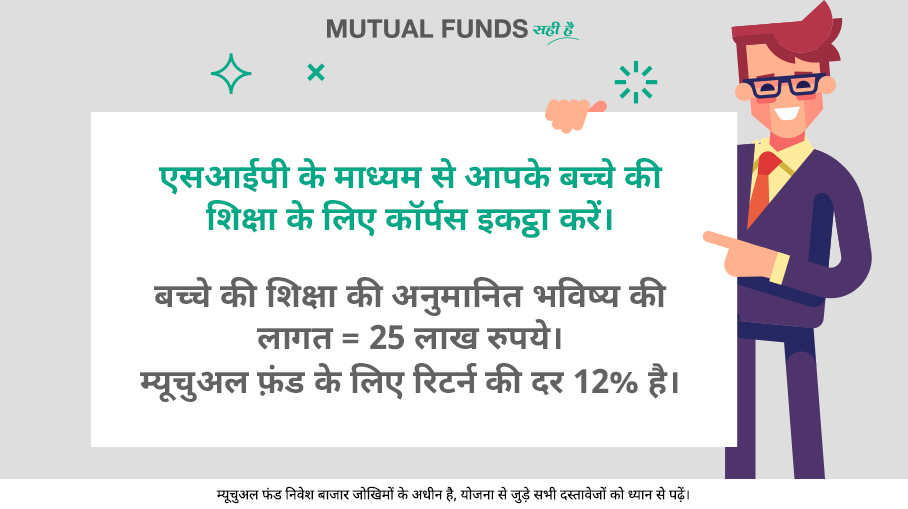

Systematic Investment Plans (SIPs) are a powerful tool for building wealth over time, providing the benefits of disciplined investing, rupee cost averaging, and compounding. They are ideal for both new and seasoned investors looking to achieve their financial goals through a structured and convenient approach. Whether you’re saving for a child’s education, a home, or retirement, starting a SIP today can help you secure a brighter financial future.

This blog post is designed to educate readers on the benefits and workings of Mutual Fund SIPs, encouraging them to consider SIPs as a viable investment option for long-term wealth creation.