DSA Means Direct Selling Agent. LandT Finance Congratulations 🎉 Get a Personal Loan up to Rs. 7 Lakhs in 2 minutes.

L&T Financial Services offers personal loan under the name of Consumer Loans. L&T Finance personal loan can be used for any immediate financial needs, including festivals, marriages, house renovation, education, medical expenses, etc. The application process is completely digital and easy. You can get up to Rs. 7 Lakhs as the loan amount at 11% interest rates for tenure up to 48 months.

L&T Finance Limited is a non-banking financial company that offers a range of financial products and services, including personal loans. L&T Finance may work with DSAs (Direct Selling Agents) to help customers access its personal loan products.

L&T Finance Personal Loan Features

The features of L and T Finance personal loan are mentioned below in detail:

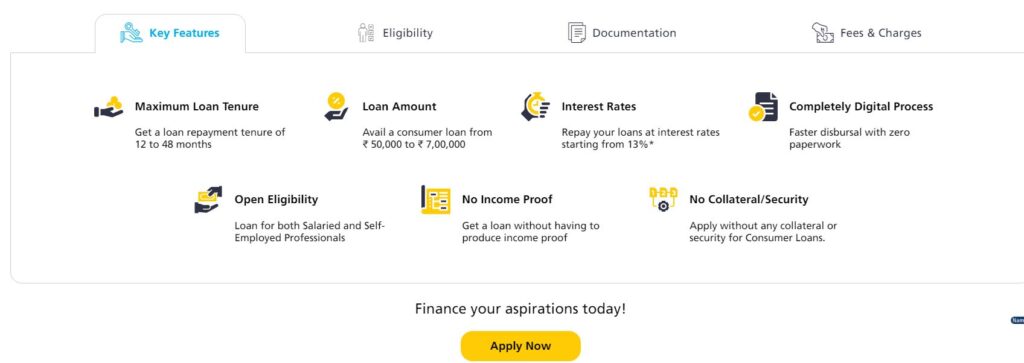

Loan amount: You can avail of a loan amount of as low as Rs. 50,000 and a maximum up to Rs. 7,00,000 from L&T Finance from L&T Finance personal loan app or website.

Purposes: L and T personal loan is unsecured in nature and can be used for a variety of reasons such as education, home renovation, wedding, travel, medical emergency or general purposes.

Tenure of repayment: The repayment tenure for the loan ranges from 12 months to 48 months.

Rate of interest: L&T Finance personal loan interest rate starts from as low as 11% per annum.

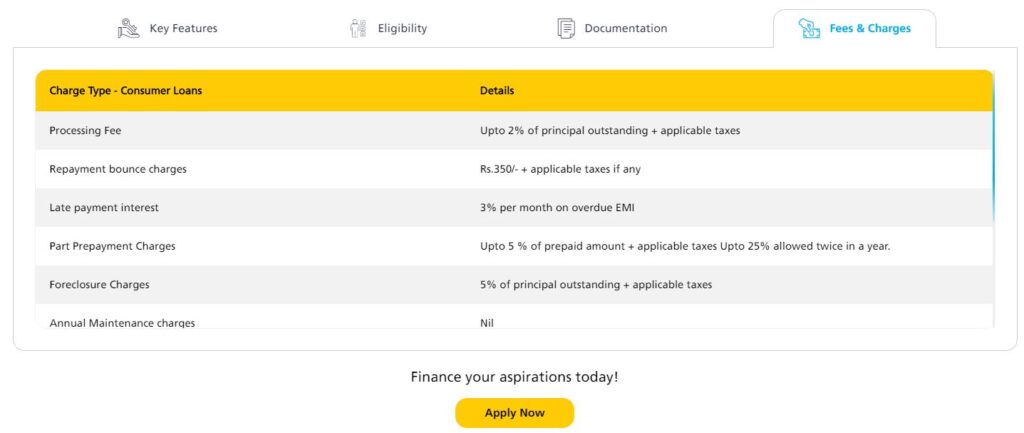

Processing fee: A processing fee of 1.75% to 2% of the sanctioned loan amount will be applicable.

Eligible applicants: Salaried and self-employed professionals who are Indian citizens and have valid ID proof.

Age criteria: If you want L&T Finance personal loan apply online after you turn 23 years old and before 58 years of age.

Benefits: Completely digital application process, fast disbursal, and no income proof documents required.

Joining as a DSA/ Partner Apply Now : Click here

Features and Benefits

💰 Personal Loan for Salaried and Self-Employed Individuals

Low interest rates -·

No income proof documents required

Quick disbursal in 10 minutes 💰

L & T Personal Loan

If you are looking for a personal loan from L&T Finance, you can reach out to a loan DSA who can help you with the loan application process. The DSA will collect your personal and financial information and verify your eligibility for the loan. They will also help you understand the terms and conditions of the loan and guide you through the application process.

It’s important to note that while loan DSAs can be helpful in finding and applying for a loan, you should always do your own research and make sure you understand the loan terms before signing any agreements. Be sure to compare loan options from different lenders and choose the one that best fits your financial situation and needs.

Criteria

- CIBIL 750 Plus

- No More than 2 Loan LIVE

- No Inquiry Last 3 Month

joining Process of L & T Personal Loan DSA Joining Click here

Frequently Asked Questions

Have more doubts about Consumer loans? Get all your queries answered here.

1. What is a Consumer Loan?

A Consumer Loan is an unsecured loan that can be used for variety of reasons such as education, home renovation, wedding, travel, medical or for general purposes.

2. Why should I take loan from L&T Finance?

Key Features of L&T Finance Consumer Loan are Completely Digital Process, Quick disbursal, Transparent, No security needed, Minimum documentation.

3. When can I apply for Consumer Loan?

Anyone in the age group from 25 years to the age of 58 years on loan maturity can apply for a Consumer Loan, provided the applicant has the required documents.

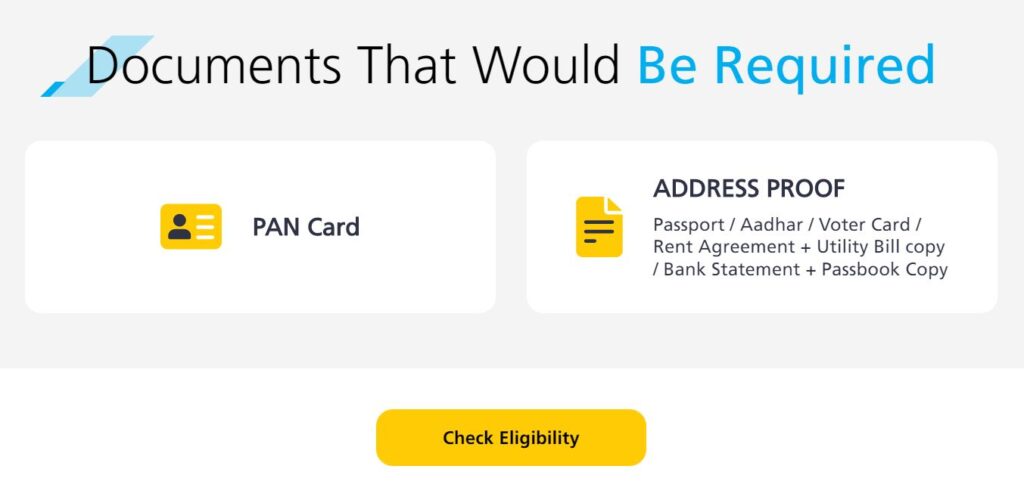

4. What are the documents to be provided?

Aadhar Number, Pan Number, Current address proof & bank details

5. How can you register for Do Not Disturb?

We (L&T Finance Limited – Consumer Loans, agents, representatives) would like to keep our customers updated on their pre-approved personal loan offers. We do respect your privacy, and appreciate that some of you may not want to receive such information from us. If this is the case, click here to register for any/all the channels. Please note that by registering for the Do Not Disturb service of L&T Finance Limited – Consumer Loans you shall not receive such information for your pre-approved personal loan offers through the channels registered by you post 7 days from registration. To ensure that you may not receive any unsolicited commercial calls please contact your telephone service provider for registration in the National Do Not Call Register of Telecom Regulatory Authority of India (TRAI). If, however, you still receive any unwelcome call or SMS: Please write to us at customercare@ltfs.com indicating, if possible, the telephone number or channel from which the call or SMS was made.

6.How can I check my L&T Personal Loan Status?

After approval of your personal loan L&T Finance will send you an SMS confirming the approval of your loan. For any query regarding your loan status, you can send an email at customercare@ltfs.com or call the L&T personal loan contact number on +91 7264888777.

7.How can I check my L&T EMI online?

You can use the L&T Finance EMI Calculator available on the lender’s website to check your L&T EMI online. Following are the easy steps to use the tool:

Open the EMI Calculator page.

Enter the required Loan Amount in Rupees.

Enter the Interest Rate per annum in percentage.

Enter the Loan Tenure in months.

As soon as you enter all the details, your Equated Monthly Instalment (EMI) will be calculated and displayed on the screen instantly.

You can click the ‘RESET’ button to re-enter the entered loan values.

- Omozing : Quick Personal LoansOmozing – Quick Personal Loans: Fast, Flexible Financial Relief You Can Trust In today’s fast-paced world, unexpected expenses can derail even the best-laid plans. At …

- 🚀 Side Income Ka Super Formula! – Loan या Credit Card Agent बनकर Mahine Ke Lakhs कैसे कमाएं?Kya aap bhi soch rahe ho – sirf dusron ki financial help karke apni income max kaise kar sakte ho?Aaj main aapko woh Secret Strategy …

- 💡 Loan Against Mutual Funds (LAMF): The Smart Investor’s Strategy to Unlock Wealth Without SellingIn today’s dynamic financial landscape, investors often find themselves in a cash crunch. Whether it’s an unexpected expense or a lucrative opportunity, the need for …

- 💰 Lendingplate Personal Loan – Your Trusted Partner for Instant Funds!In today’s fast-paced world, financial emergencies can strike without warning – medical bills, wedding expenses, home upgrades, or even education costs. Thankfully, Lendingplate Personal Loans …

- WeRize Personal Loan – Ek Smart Financial Solution Aapke Sapno Ke LiyeCompany History – WeRize Ka Safar WeRize ek Indian fintech startup hai jo 2019 mein launch hua tha, jiska main focus hai Bharat ke tier …