Instant Personal Loan in Minutes

Plan your dream wedding, get your dream gadget, pay off school fees, our personal loan is the go-to place for all your immediate financial needs.

Avail of an instant personal loan up to Rs. 10 Lakhs in minutes with Piramal Finance at an attractive interest rate of 12.99% p.a. onwards. The Piramal Finance personal loan can be repaid with a flexible loan tenure of up to 60 months. You can use the loan amount for planning a dream wedding, getting the latest gadget, paying off school fees, or any other immediate financial need.

Benefits of Personal Loan at Piramal Finance

Piramal Finance offers the best personal loan in India. Some of the benefits of availing of a personal loan from Piramal Finance include competitive personal loan rates, quick personal loan sanction and disbursal, flexible repayment tenure, and many more.

Zero Foreclosure Charges Zero pre-payment and foreclosure charges

Clubbing Incomes for higher loans Piramal finance offers great flexibility of clubbing incomes for higher loan amounts eligibility

Quick Disbursals Quick sanctions and smooth disbursal processes: You repay your debts or do major purchases, and we will handle all the formalities.

Personal Loan EMI That Fits Your Pocket There are multiple options available when it comes to framing a personal loan structure that suits your requirements. We empower a lot of flexibility in the loan tenure, prepayment and foreclosure as well.

Minimum Documentation To further ensure an easy and hassle-free process of a personal loan application, Piramal Finance requires minimal documentation.

Piramal Housing Finance Personal Loan Features & Benefits

- Loan starting from Rs. 1 lakh to Rs. 10 lakhs – Fulfil your financial needs by availing loan of any amount within the given range.

- Minimum documentation – Less paperwork, seamless experience.

- Quick sanction and instant disbursal – Get all the information at your fingertips instantly regarding the loan.

- Pocket-friendly monthly EMIs – This is the most significant advantage. You can register for the loan without worrying that you have to pay the entire cost.

- Flexible repayment tenure starting from 12 months to 60 months – Select the best option for loan repayment tenure and enjoy the benefits of reduced EMI and other repayment factors.

- Clubbing income for higher loan eligibility – Club your income with any of your family members to get a higher loan.

Who Can Apply for Piramal Personal Loan

Those salaried employees who work under the following can apply:

- Government Institution

- Private sector

- Public sector

- MNCs or related companies

- Partnership Firms

- Proprietorship concern

The age of these salaried employees should be between 21 to 60 years.

How to apply for a personal loan from Piramal Finance?

Step 1: Click on Apply Now and start your digital Instant Personal loan application

Step 2: Once you have applied for the personal loan, enter your mobile number that is linked to your bank account

Step 3: You will receive an OTP on your mobile number. Enter the OTP to proceed.

Step 4: Next, enter your PAN details and confirm the same

Step 5: After filling and confirming the PAN details, enter your employment details and confirm the same

Step 6: After this, complete your KYC and select your address

Step 7: Once you have completed your KYC, view your loan offer

Step 8: Now that you viewed your loan offer, enter your bank account details

Step 9: Next, verify your bank account details and confirm the same

Step 10: Once you have verified your bank account details, upload your bank account statement and salary slips

Step 11: Now, verify your income

Step 12: Take a selfie and verify the same

Step 13: Once you have verified your selfie, view your loan details and edit it if necessary

Step 14: After you have completed all the edits, set up auto-pay

Step 15: Complete your auto-repayment setup

Step 16: View your final offer details

Step 17: Check your loan application status

Step 18: And lastly, download the Piramal Finance App to track your loan details, statements, credit score, etc.

Piramal Finance Personal Loan Fees & Charges

Following are the fees and charges applicable when availing of a personal loan from Piramal Finance:

- Processing fee: Up to 4% of loan amount + applicable taxes.

- Default interest: 2% p.m. on default of PEMII/EMI.

- Part payment/Foreclosure charges: Nil.

- Loan pre-closure statement: Rs. 1,000 + applicable taxes.

- Loan repayment instrument dishonour charges: Rs. 500 + applicable taxes.

- Loan Repayment schedule (for physical copies): Rs. 500 + applicable taxes.

- Photocopy of documents: Rs. 1,000 + applicable taxes.

- Additional charges for non-compliance with any terms &conditions of the transaction documents: 2% p.m. on the outstanding amount.

Get a Quick Personal Loan from the Nearest Piramal Finance Branch

Ahmedabad Pune Jaipur Mumbai Hyderabad Indore Delhi Noida Nashik Surat Gurgaon Bangalore Chennai Thane

How can I apply for a Piramal Finance personal loan?

You can apply for the loan online by visiting Piramal’s website and filling out the application form. Alternatively, you can also call them at 1800 266 6444 to apply for the loan.

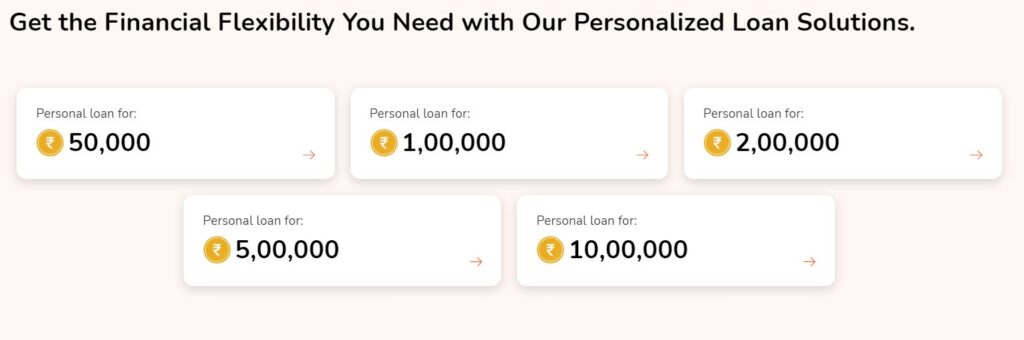

How much personal loan amount can I get from Piramal?

You can get anywhere between Rs. 1 Lakh to Rs. 10 Lakhs depending on your eligibility.

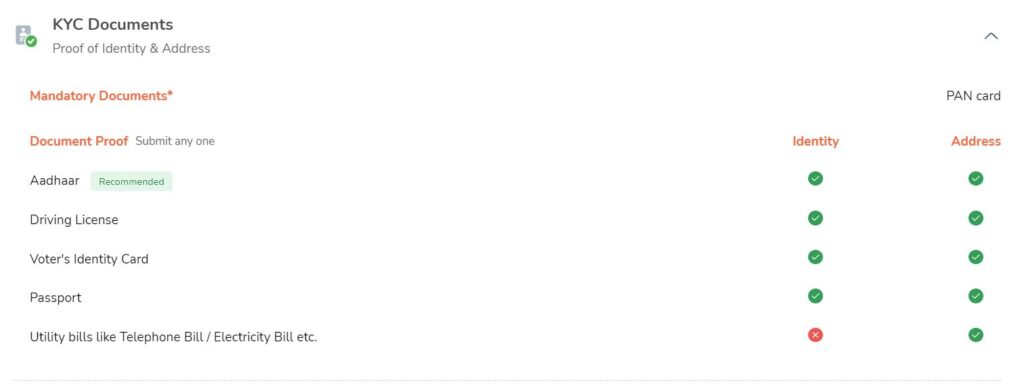

What are the documents needed to apply for a personal loan at Piramal Finance?

The documents required to apply for a Piramal Finance personal loan include PAN Card, identity proof, address proof and income proof.

Does my credit score impact my chances of getting a Piramal Finance loan?

Yes, your credit score is one of the most important factors considered by Piramal while approving your loan application. A good credit score increases your chances of getting hassle-free and quick approval for a personal loan from Piramal Finance.

- Omozing : Quick Personal LoansOmozing – Quick Personal Loans: Fast, Flexible Financial Relief You Can Trust In today’s fast-paced world, unexpected expenses can derail even the best-laid plans. At …

- 🚀 Side Income Ka Super Formula! – Loan या Credit Card Agent बनकर Mahine Ke Lakhs कैसे कमाएं?Kya aap bhi soch rahe ho – sirf dusron ki financial help karke apni income max kaise kar sakte ho?Aaj main aapko woh Secret Strategy …

- 💡 Loan Against Mutual Funds (LAMF): The Smart Investor’s Strategy to Unlock Wealth Without SellingIn today’s dynamic financial landscape, investors often find themselves in a cash crunch. Whether it’s an unexpected expense or a lucrative opportunity, the need for …

- 💰 Lendingplate Personal Loan – Your Trusted Partner for Instant Funds!In today’s fast-paced world, financial emergencies can strike without warning – medical bills, wedding expenses, home upgrades, or even education costs. Thankfully, Lendingplate Personal Loans …

- WeRize Personal Loan – Ek Smart Financial Solution Aapke Sapno Ke LiyeCompany History – WeRize Ka Safar WeRize ek Indian fintech startup hai jo 2019 mein launch hua tha, jiska main focus hai Bharat ke tier …