India’s first full stack financial services platform for small city India.

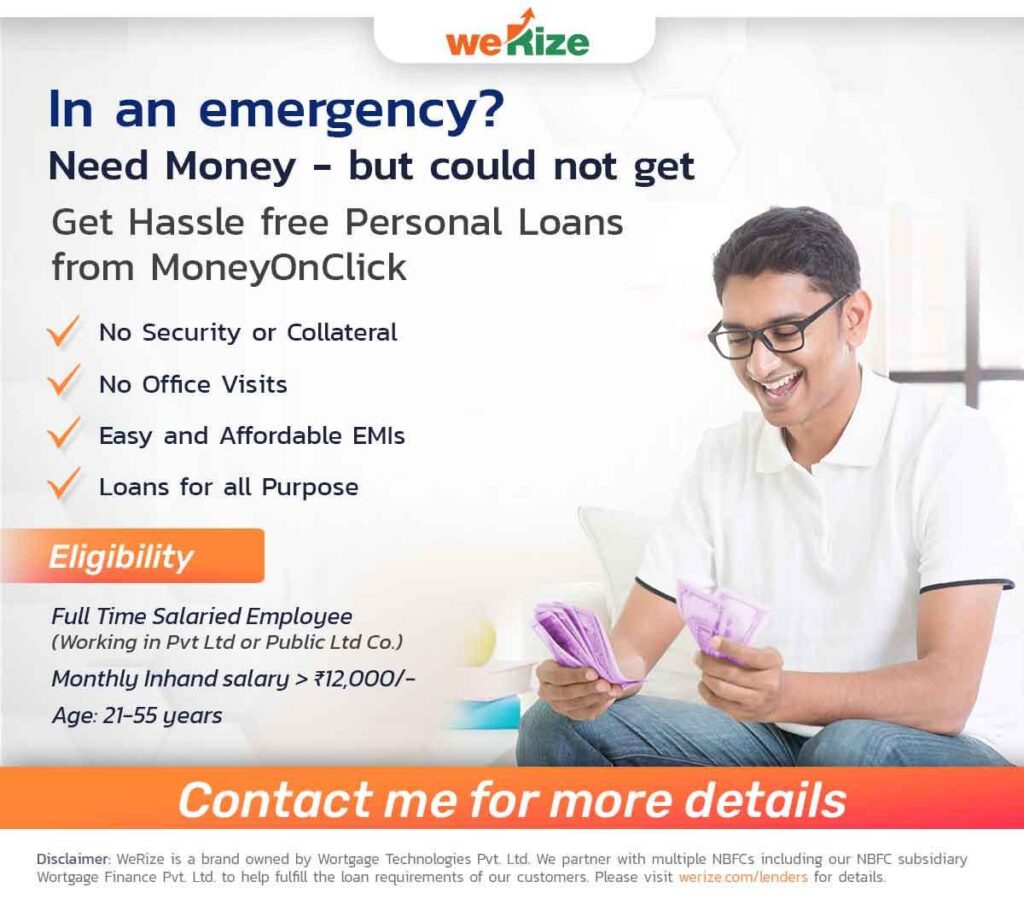

About the product:

Personal loan is an unsecured form of credit to enable the customer meet personal or emergency

requirements. It is multi-purpose in nature and therefore can be used for various purposes

including wedding, home renovation, travel purposes and more. The documentation required is

minimum with the ease of getting the amount completely digitally without any hassle.

Key features of the product:

- No collateral / security

- 100% digital

- Quick approvals

- Easy and hassle-free process

- Short term loan

- Minimal documentation

- No hidden charges

* WeRize is a full-stack provider, both manufacturing and distributing a wide portfolio of customized credit, insurance, and savings products for 300Mn individuals spread across the 4000+ Tier 2 to Tier 4 towns .

Our mission is to manufacture and distribute customized lending, banking, group insurance* and savings products for 300Mn customers and their families in 4000+ small towns across India and help them rise in their lives. We have also created a unique “Social Shopify of Finance” social distribution tech platform to reach these customers and provide them high-touch sales and after sales services.

Wortgage finance private limited holds RBI NBFC license (N-02.00325) which enables us to conduct lending activities in India.

Loan Details:

- Personal Loan

- Ticket size from Rs.50,000 to Rs.5 lakhs

- Flexible Tenure, from 12 to 36 months

Loan Amount: From ₹30,000 to ₹5,00,000

Repayment Duration: From 12 months to 3 years

Annual Interest Rate: From 15% – 36%*

Processing Fees: From 2% – 3%*

We maintain complete transparency, there are no hidden charges.

Documents Required for taking loans:

– PAN Card

– Aadhaar Card

– Bank Statement

– Latest Salary Slip

Our customers require high touch sales and after sales service which can only be provided by a distributed model. We have built a unique social distribution “Finance ki Dukaan” tech platform using which 1000s of financially literate freelancers sell our products to their friends and families.

Purpose of Loan:

- Travel – Get a personal loan to fulfil your travel needs and travel to the destination of your

dreams. Get a much-required breather from daily hassle and come back energised - Education – Apply for an instant personal loan to help yourself or your family to pursue

higher education or professional certification and help create a brighter and more

successful career ahead - Emergency – A quick and hassle-free personal loan to fulfil your needs at the time of an

emergency to be with your loved ones when they need your support. To support any

financial need arising at the time of emergencies - Shopping – Want to buy the latest gadget or plan to buy an expensive gift for your loved

one, this personal loan will help you fulfil all your shopping needs - Wedding – Planning for a dream wedding, let us help you with the finances and help you in

making this occasion a memorable one.

- Omozing : Quick Personal LoansOmozing – Quick Personal Loans: Fast, Flexible Financial Relief You Can Trust In today’s fast-paced world, unexpected expenses can derail even the best-laid plans. At Omozing, the mission is clear: make personal loans fast, fair, and tailor-made for you—even if your credit score isn’t perfect. What’s Omozing All About? Omozing – Your Smart Personal Loan …

- 🚀 Side Income Ka Super Formula! – Loan या Credit Card Agent बनकर Mahine Ke Lakhs कैसे कमाएं?Kya aap bhi soch rahe ho – sirf dusron ki financial help karke apni income max kaise kar sakte ho?Aaj main aapko woh Secret Strategy batane wala hoon, jisse hazaron log financial freedom hasil kar chuke hain. ✨ About Us – Hum kaun hain aur hum pe trust kyun karein? Soch rahe ho kaunsa platform …

- 💡 Loan Against Mutual Funds (LAMF): The Smart Investor’s Strategy to Unlock Wealth Without SellingIn today’s dynamic financial landscape, investors often find themselves in a cash crunch. Whether it’s an unexpected expense or a lucrative opportunity, the need for instant liquidity is real.But here’s the truth: Selling your mutual fund investments may not always be the smartest move.Instead, savvy investors are choosing Loan Against Mutual Funds (LAMF) — a …

- 💰 Lendingplate Personal Loan – Your Trusted Partner for Instant Funds!In today’s fast-paced world, financial emergencies can strike without warning – medical bills, wedding expenses, home upgrades, or even education costs. Thankfully, Lendingplate Personal Loans offer a smart, fast, and reliable way to meet your financial goals without collateral or paperwork hassles.With Lendingplate, you get instant personal loans online, tailored to your needs – safe, …

- WeRize Personal Loan – Ek Smart Financial Solution Aapke Sapno Ke LiyeCompany History – WeRize Ka Safar WeRize ek Indian fintech startup hai jo 2019 mein launch hua tha, jiska main focus hai Bharat ke tier 2 aur tier 3 cities ke logon tak financial products pahuchana. Founders Vishal Chopra (ex-Lendingkart) aur Himanshu Gupta (ex-Shuttl) ne milkar WeRize ki shuruaat ki thi ek mission ke saath …