We Suggest Best Loan Company for Apply Online and Offline.

Big or small, Financial Galaxy has all your funding needs covered. Borrow a Personal Loan for Salaried Employees from anywhere between Rs. 50,000 to Rs. 35,00,000.

Features:

- No Collateral/Security

- Instant approval

- No physical interaction required

- Credit Score 700 Plus

- Minimal Documents: KYC | Salary Slip | Banking [e-Pdf] and Basic Details

List of Bank/NBFC and App for Loan

Offer Details

Navi is a digital lending app which provides you loans upto ₹10 lakh instantly through a completely paperless process.

Features and Benefits of Navi Personal Loan

Eligibility Criteria of Navi Personal Loan Instant Approval

Benefits of Applying for a Loan with Poonawalla Finance

- Flexible Loan Options: Choose from a variety of loan types, whether for ersonal needs, business, or more.

- Quick Approval & Disbursement: Fast processing ensures you get your funds when you need them!

- Low-Interest Rates: Enjoy affordable EMIs with competitive interest rates.

- Easy Online Application: Apply from anywhere with their user-friendly online platform.

- No Hidden Fees: Transparent process with zero hidden charges.

Ready to get started?

Looking for a Personal loan? EarlySalary is a one stop solution for all your instant cash needs

Reasons to apply for EarlySalary:

100% online application process

Loan tenure - 3 to 60 months

Quick loan disbursal

Docunment: KYC | Banking 3 Month only

Use link and Download the EarlySalary app today ?

Instant Approval : Get quick approval and fast disbursement to meet your financial needs without delays.

Flexible Loan Amount : Borrow as per your needs with customizable loan amounts to fit your budget and requirements.

Minimal Documentation : Enjoy a hassle-free application process with minimal paperwork, making it easier to apply.

Attractive Interest Rates : Competitive interest rates that help keep your EMIs affordable.

Convenient Repayment Options : Choose from multiple repayment options that suit your cash flow, ensuring easy and stress-free EMI management.

100% Digital Process : Complete the entire process online through the ABFL OneApp, from application to disbursement, without any physical visits.

24/7 Accessibility : Apply anytime, anywhere through the app, giving you the flexibility to access funds whenever needed.

Get personal loans for all your requirements with WeRize Loan starting from Rs. 50,000/- to Rs. 500,000/-

No gold, no collateral!

Flexible repayment options

Interest rates starting from 1.5% per month

No need to visit any branch

Docunments: KYC | Salary Slip | Banking 12 Month

PF Didcution is Compulsary with PVT , LTD and Govt Salaried Only [Not for Properiter and Partnership Company]

Only for Salaried professionals with minimum monthly salary of Rs. 13,000/-

Looking for an instant Personal loan? Avail instant loans upto Rs. 2 lakhs anytime-anywhere with PayMe India

Why choose PayMe India?

Easy online application process

Loan tenure - 3 to 4 months

Minimal documentation : KYC | Salary Slip | Banking 4 Month

Use link and Download the PayMe India app today ?-

Instant Credit Lines Up To ₹ 3 Lakh Low Cost EMIs

Affordable Interest Rates

Flexible Payment Tenures

Safe & Trustworthy

Superfast Processing

Minimal Documentation

Fast Query resolution

2 Year Experiance Required

Docunments: KYC | Salary Slip | Banking 6 Month | Selfie

IIFL Salaried Personal Loan Apply

Instant Check Eligibility

Basic Details

No Ownership and Salary Slip

Docunment : KYC| Banking 6 Month

Check Eligibility now

Looking for a Personal loan? Get instant NIRA personal loan of up to Rs. 1 Lakh

Reasons to apply for NIRA Finance:

Easy online application process

Loan tenure - 3 to 12 months

Minimal documentation : KYC | Salary Slip | Banking 3 Month

Use link and Download the NIRA app today ?

Salary Dost personal loans up to INR 5 lakhs

Avail super-low interest rates

Get quick dispersal with an easy process

No paper work Hassle free loan

No waiting in queue Apply now:

Instant Approval and Quick Disbursal

Get your loan approved and disbursed in minutes, perfect for urgent financial needs.

No Collateral Needed

KreditBee offers unsecured personal loans, so you don’t have to pledge any assets.

Flexible Loan Amounts

Choose a loan amount that suits your requirement, from small short-term loans to larger personal loans.

Easy Repayment Options

With flexible tenure options, you can choose repayment schedules that fit your cash flow.

Minimal Documentation

Apply easily with minimal paperwork, making the process smooth and hassle-free.

24/7 Accessibility

Apply anytime, anywhere through the KreditBee app, without needing to visit a branch.

Customized Loan Offers

Get personalized loan offers based on your profile, ensuring you have options tailored for you.

- Instant Approval – Bina zyada paperwork ke, turant approval ka suvidha.

- Flexible Repayment Options – Aapki comfort ke hisaab se EMI plans available hain.

- Low-Interest Rates – Affordable interest rates ke saath, EMI bhi light hai!

Apply karo abhi aur pao apni financial zaruratein poori!

Faircent is Fast and Minimum Docs With Fulfill Dreams.

Salary credited by Cash/Cheque /UPI salary :Not allowed

Location PAN India

All type Company Accepted like Properiter, Partership,PVT ltd and Govt

Both Rented Case Accpted

Salaried Employee Only

PAN India Work

Credit Score 550+ | New to Credit

Not for Partnership and Propritership Compny.

Salary only NEFT/RTGS/UPI only .

Looking for a Personal loan? Get an instant personal loan up to Rs. 10 Lakhs from Finnable

Reasons to apply for Finnable:

Easy online application process

Loan tenure - 6 to 60 months

Minimal documentation

Use link and Download the Finnable app today ?

Some Tips and Information

Salaried employee Get Personal Loan its Small Tenure and Small Amount Compare to Business Loan.

Do You Know this Facts???

Business Loan and Personal Loan is Category under Unsecured Loan.

Some Note:

No Pay Any Fees for Loan Process Before Disbursement. or we Not any Collect Money for Loan Agreement or Process any ways. So Aware.

SimplyCash by HeroFinCorp is an android based end to end digital loan app.

Loan Amount - 50K to 1.5 Lac

Parameters:

Bureau Score 500-700

Average Monthly Bank Balance 5000+

Income between 2.5Lac to 5.5Lac

Looking for a Loan? LoanTap’s personal loans are flexible, pocket friendly and fastest. Get instant loan up to ₹10 Lakhs

Reasons to apply for LoanTap loans:

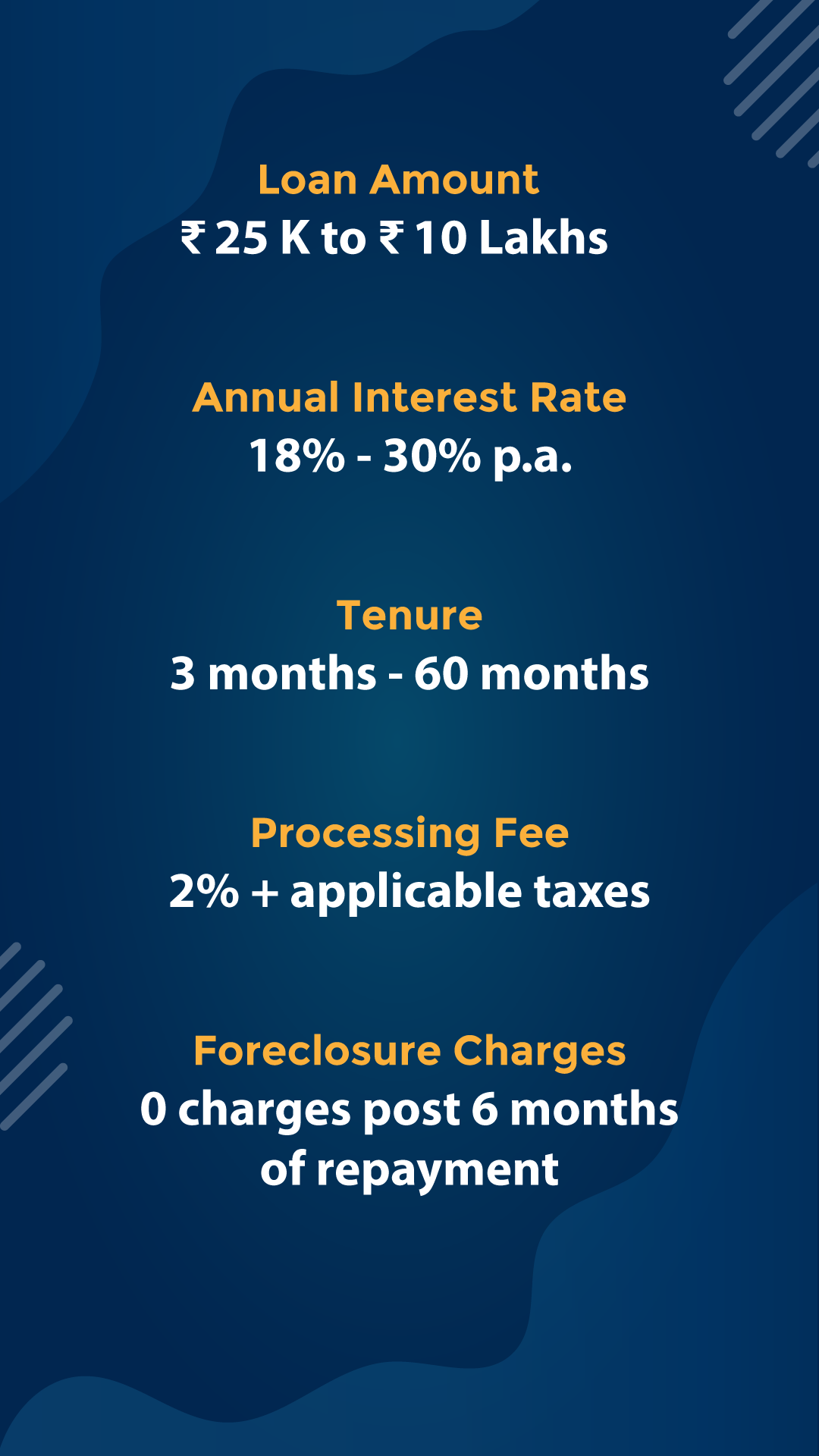

Easy online application process

Interest rates ranging from 18% - 30% p.a.

Instant approval and quick disbursal

Ownership Required

Salaried Professional Only

Use link and Download the LoanTap app now ?

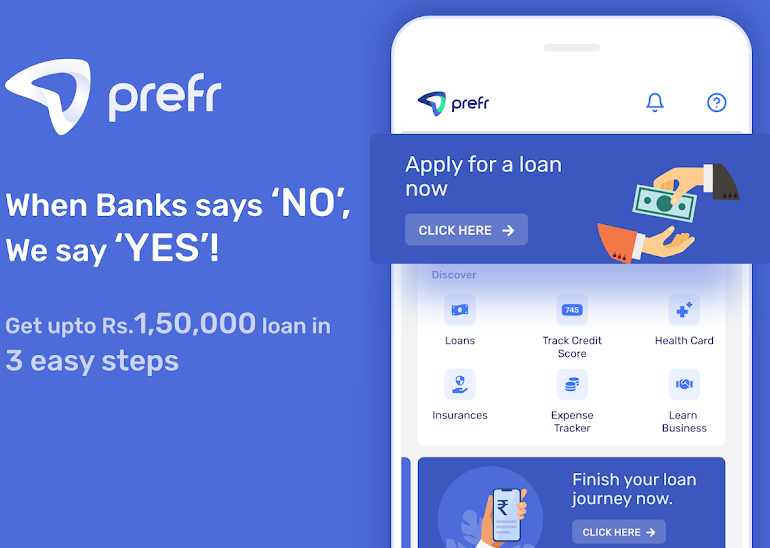

Prefr Credit is an app made for the unsung heroes on the back of whom India runs on a daily basis.

With Prefr, we give you instant personal loan upto ₹3,00,000 directly in your bank account so that you can progress and grow in life not just personally but also professionally without any barrier or hesitation.

At Prefr, all the loans are financed by our lending partners - Hero FinCorp Ltd and Piramal.

Check Offer now

Looking for a safe and reliable platform for an urgent need of funds? MoneyTap is here to provide you with a credit line to serve your financial needs

Benefits of using MoneyTap Personal Loan:

Approved credit limit of up to ₹5 Lakh

Borrow flexibly

Safe & Secure Credit

Get cash in your account instantly with MoneyTap.Use link and Download the MoneyTap app today ?

Paysense :

Completely Digital process, No physical Documents Required.

We Can Fund in Propritorship, Partnership, LLP, Trust, Hotel, Pvt ltd, LTD Driver profile, Government employees, Also we do Class 4 Employee.

Cibil score should be above 750

No verification, No Credit PD call

Disbursement TAT is only 2 hour

Salary slip required, Salary slip is require only in few cases.

End Use of Personal Loan

Personal loan Can use Wedding, Family Function , Medical , Travels and Other Activity for Personal Touches. [Not for Start Business]

Making Personal loans Better Avail from ₹5K to ₹5L in minutes!

Income should be received in a bank

Min CIBIL score of 600 or Experian score of 650

Should be aged between 21 years and 57 years

Documents: KYC | Salary Slip | Banking 4 Month

No credit history required Get a loan from us even if you have never taken one before.

No hidden charges Transparent terms & conditions for your peace of mind

Only 2 documents needed Only two documents required to process your loan

Should be an Indian Citizen with minimum age of 19 years and maximum age of 68 years

Should have a valid ID proof and address proof

Should have an active bank account

Should be salaried or self-employed, drawing a fair income

Employees of private limited companies, employees from public sector undertakings, including central, state and local bodies

Individuals between 21 and 60 years of age

Individuals who have had a job for at least 2 years, with a minimum of 1 year with the current employer

Those who earn a minimum of 25,000 net income per month.

Same Day Disbursement with Low Processing Fee. Check offer now

100 % Paperless Process | Quick Disbursement

Credit Score 750 Plus

Overall Experiance more than 1 Year

Documents: KYC | Salary Slip | Banking 6 Month | 3 Month Salary Slip | Form 16 Required

Loan amount starting from 40 thousand to upto Rs. 35 lakhs

No Collateral/Security

Age should be between 22 to 58 years

Minimum Document

Minimum of Three year of work experience

Documents: KYC | Salary Slip | Banking 6 Month and Form 16| Salary Slip

Instant approval | No physical interaction required

Credit Score 710 Plus | Minimal documentation

Employee of LLP, Pvt Ltd, Public Ltd, Government

No Address proof require if Mobile number or Email id linked with Adhar card.

Complete Digital Process with Video kyc.

EPF Deduction or Official mail id optional for listed company & Unlisted company

Documents: KYC | Banking 3 Month [e-pdf] and Salary Slip

Existing To Bank -25000 Minimum Salary

NTB - 50,000 Tire -1 City

NTB -30,000 Tire-2 City

Depending on your requirements you can apply for 24x7 Personal Loans for amounts from Rs. 50,000/- to Rs. 10,00,000/- basis your eligibility and offer Instant approval

No physical interaction required

Credit Score 700 Plus

Minimal documentation

Documents: KYC | Salary Slip 2 Month | Banking 6 Month and form 16

Loan amounts up to Rs.15 lakh

Pre-qualified offer - NO income documents required

Easily complete KYC online via video call with bank representative

Quick approval, flexible tenure

No guarantor required | Has pre-closure option

Speedy approval process and quick disbursal

For salaried, 2 years minimum overall work experience with 1 year minimum experience in current company.

Documents: KYC | Salary Slip | Banking 6 Month

Looking for a Personal loan? With a Bajaj Finserv Personal Loan, you can get up to Rs. 25 lakhs at an attractive interest rate

Why choose Bajaj Finserv Personal Loan?

Quick loan approval

Loan tenure - 12 to 60 months

Minimal documentation

Use my link and apply online for Bajaj Finserv Personal Loan now! -

Unsecured

Not any Physical Security for Loan its basis on Credit of Financial Report.

Salary Below Suitable Loan

Easy to Apply Personal Loan Application and fulfill Needs.

Then Privo is what you need. Get an instant credit line up to Rs. 2 Lakhs to fulfill all your needs

- Top benefits for you: Easy online application process

- Flexible EMI

- Instant approval and quick disbursal

Why you should apply from here:

- 100% Fast and Secure

- Paperless Documentation

Check your eligibility and apply for Privo Credit Line now!

Choose from a long list of Lenders to get Personal Loan.

Check your Free CIBIL Report

Instant Loan Offer and Card

No Hidden Charges

Easy Process online

Check Now

- Omozing : Quick Personal LoansOmozing – Quick Personal Loans: Fast, Flexible Financial Relief You Can Trust In today’s fast-paced world, unexpected expenses can derail even the best-laid plans. At Omozing, the mission is clear: make personal loans fast, fair, …

- 🚀 Side Income Ka Super Formula! – Loan या Credit Card Agent बनकर Mahine Ke Lakhs कैसे कमाएं?Kya aap bhi soch rahe ho – sirf dusron ki financial help karke apni income max kaise kar sakte ho?Aaj main aapko woh Secret Strategy batane wala hoon, jisse hazaron log financial freedom hasil kar …

- 💡 Loan Against Mutual Funds (LAMF): The Smart Investor’s Strategy to Unlock Wealth Without SellingIn today’s dynamic financial landscape, investors often find themselves in a cash crunch. Whether it’s an unexpected expense or a lucrative opportunity, the need for instant liquidity is real.But here’s the truth: Selling your mutual …

- 💰 Lendingplate Personal Loan – Your Trusted Partner for Instant Funds!In today’s fast-paced world, financial emergencies can strike without warning – medical bills, wedding expenses, home upgrades, or even education costs. Thankfully, Lendingplate Personal Loans offer a smart, fast, and reliable way to meet your …

- WeRize Personal Loan – Ek Smart Financial Solution Aapke Sapno Ke LiyeCompany History – WeRize Ka Safar WeRize ek Indian fintech startup hai jo 2019 mein launch hua tha, jiska main focus hai Bharat ke tier 2 aur tier 3 cities ke logon tak financial products …